Trade the pattern that matters.

LogikAi transforms structural patterns into higher-probability trades—filtered by market regime, managed with precision, and gated by live win-probability. One framework, six strategies.

- Pattern detection with size & displacement awareness

- Regime filters from bars & indicators (trend, momentum, timing)

- Risk plans with structured stops, targets, and trailing logic

- AI gating via live win-probability threshold

How LogikAi Works — at a Glance

Every LogikAi strategy runs through the same engine: detect the opportunity, confirm the market regime, gate it with AI win-probability, route orders through a broker-safe execution core, then feed the results back into the optimization loop.

LogikAi turns this into a continuous feedback loop: as performance and probability data update, you can tighten filters, adjust risk, or refresh the AI model to keep the strategy aligned with current market behavior.

AI-Powered Optimization

The AI Gate in each LogikAi strategy is driven by a trained probability model. It learns which contexts win more often, sets win-probability cutoffs, and defines confidence bands that can boost or reduce position size — so the same playbook reacts differently when the edge is strong vs. weak.

How Optimization Works

LogikAi doesn’t just say “yes” or “no” to a setup. It scores each context with a win-probability, then uses cutoffs and confidence bands to decide whether to skip, take, or size up the trade.

- Outcome-Driven Training: each strategy’s AI model is trained on historical trades, learning which combinations of structure, volatility and volume most often lead to winners vs. losers.

- Probability Cutoffs & Bands: the AI Gate uses a minimum win-probability cutoff to allow or block entries, plus confidence bands that can be mapped to different position-size levels.

- Position Size Boosting: when P(win) is in a high-confidence band, LogikAi can optionally boost size within your max risk; when P(win) is marginal, size is reduced or the trade is skipped entirely.

- Regime & Drift Awareness: optimization can be refreshed as markets change, keeping thresholds and weights aligned with current volatility and regime instead of a one-time backtest.

- Feedback into the Loop: every live trade logs P(win), PnL, MFE/MAE and duration, feeding the same “Review & Optimize” step shown in the How It Works diagram for the next round of training.

Strategy Pack — Current Offering

The LogikAi pattern engine powers three active strategies, each optimized for a distinct market condition. Three more are development for release by the end of 2026.

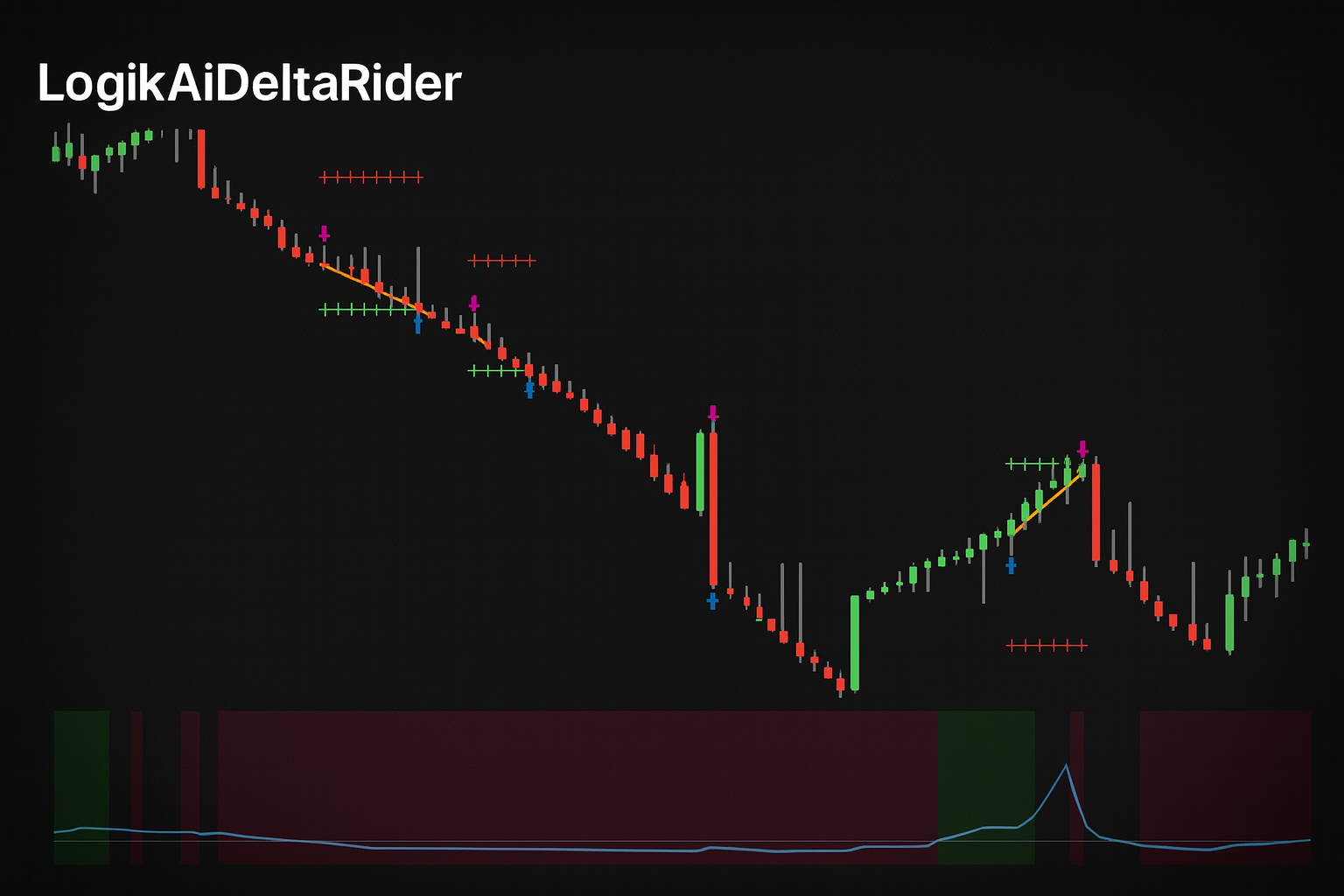

LogikAiDeltaRider

Targets trend delta impulse moves; strict skip rules in chop to protect expectancy.

- Pattern engine + delta-driven bar confirmation

- Time-based exits for stalled moves

- Confidence-weighted size (optional)

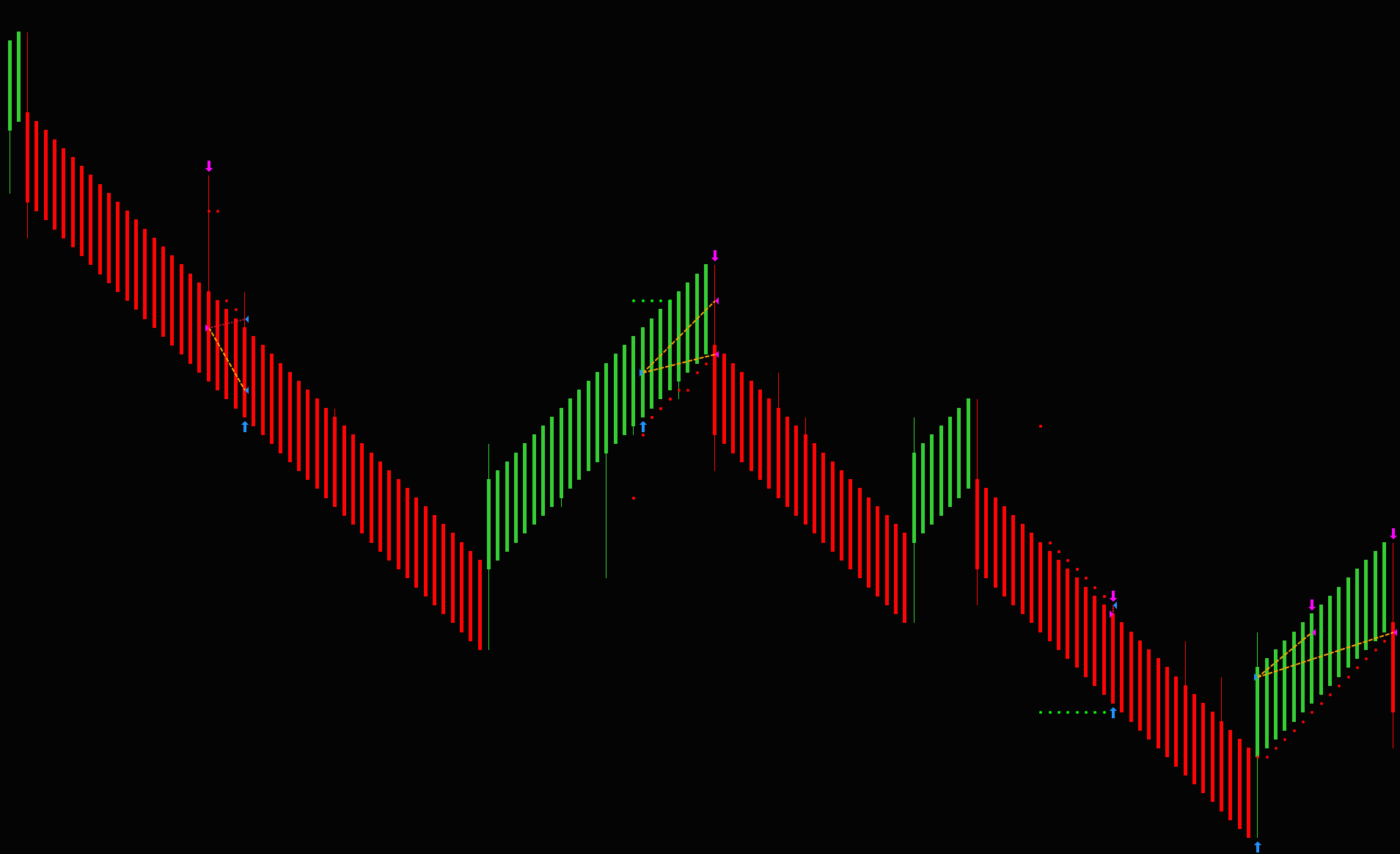

LogikAiRenkoRider

Trades rotations within Renko Bars; lets trend legs expand when warranted.

- Pattern engine + delta-driven bar confirmation

- Time-based exits for stalled moves

- Confidence-weighted size (optional)

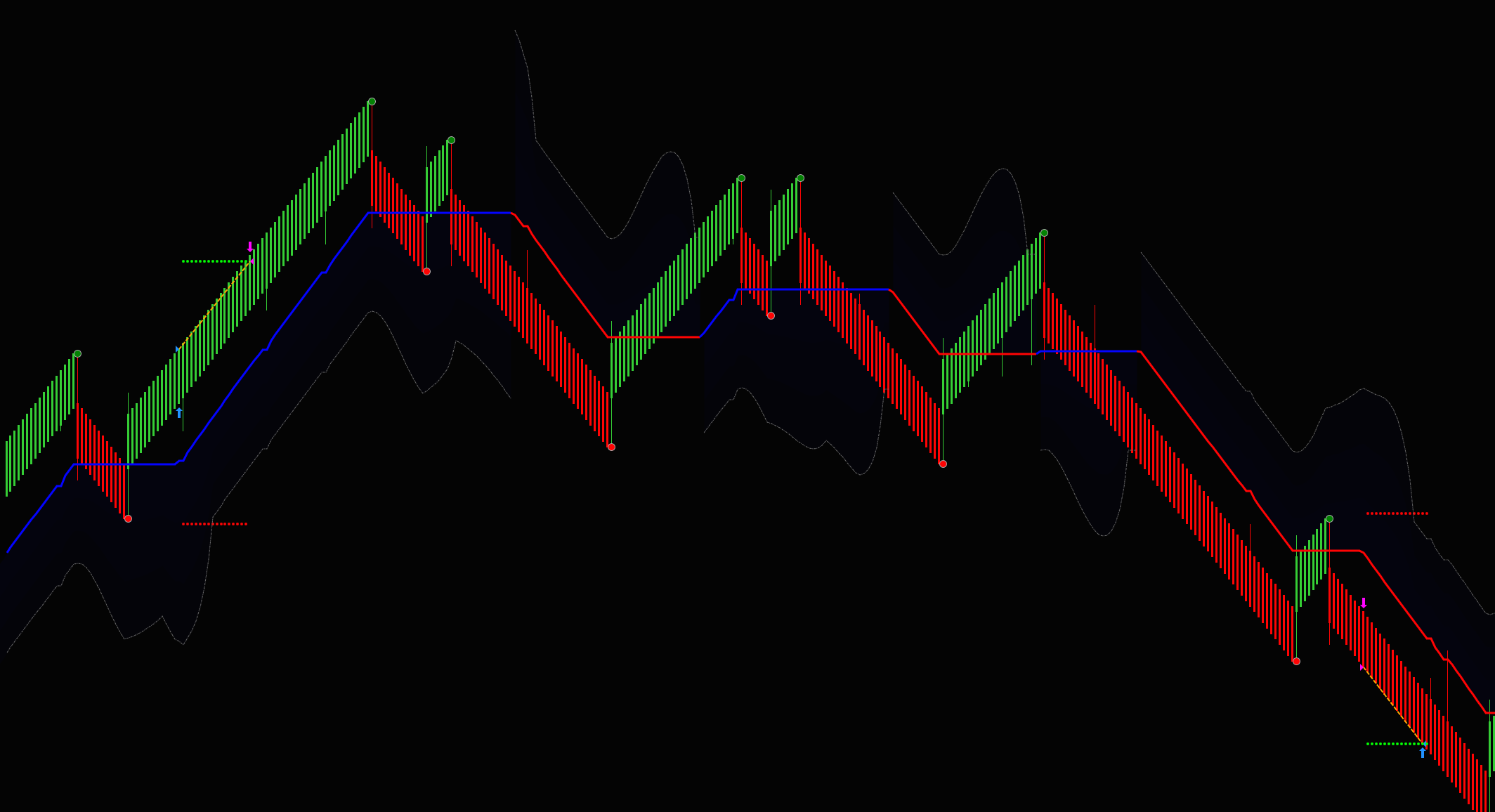

LogikAiHaRsiFusion

Blends smoothed structure with momentum to catch clean rotations and holds.

- Pattern engine + Heiken Ashi trend clarity

- RSI regime: thrust vs. retrace timing

- Risk plan toggles: fixed vs. dynamic targets

LogikAiFlowBack

Rides directional flow; only acts when displacement confirms sustained intent.

- Pattern engine gated by displacement & continuation

- Uses UltimateRenko to confirm trend persistence

- Trailing logic favors runners; time-outs curb churn

LogikAiKillZone

Focuses on high-energy session windows where follow-through tends to be best.

- Pattern engine scoped to “kill zone” time blocks

- UltimateRenko structure for clean entries

- Session-aware stop/target presets

LogikAi [TBA]

A new strategy powered by the LogikAi pattern engine, releasing late 2025.

- Next-generation pattern logic

- New bar-type integration

- Adaptive session & volatility model

What You Get With the LogikAi Strategy Suite

Your purchase is more than a single strategy. You get the LogikAi strategy engine, a set of premium bar types, and ongoing parameter updates so the playbook you’re running stays aligned with current markets.

Bundle Overview

Everything below is included with the LogikAi Strategy Suite license — no separate checkout for bar types or weekly parameter updates.

- LogikAi Strategy Suite Access: run LogikAiDeltaRider today, with additional LogikAi strategies (LogikAiLogikAverageChannel, LogikAiHaRsiFusion, LogikAiFlowBack, LogikAiKillZone and TBA) unlocked as they are released under the same framework.

- Premium Bar Types Included: LogikDeltaRenko, LogikUltimateRenko and LogikAverageExtreme are bundled so the strategies can operate on the bar structures they were designed for — no extra purchase required.

- Weekly Trade Parameter Updates: updated targets, stops and configuration guidelines for major futures like ES, YM and NQ, based on current volatility and structure.

- Symbol Expansion on Request: additional markets can be added to the weekly parameter coverage list over time as users request them.

All components share the same LogikStrategyCore framework, so as the engine and models improve, your entire suite — strategies, bar types and parameter playbooks — benefit together.

LogikDeltaRenko

Trend-sensitive delta bar type used by LogikAiDeltaRider and LogikAiFlowBack to clarify impulse and continuation moves.

LogikUltimateRenko

UltimateRenko implementation tuned for LogikAiKillZone and other session-focused strategies that need clean structure in higher-energy windows.

LogikAverageExtreme

Adaptive average/volatility engine powering bands and channels in LogikAiLogikAverageChannel and related mean-reversion / expansion logic.

Weekly Futures Parameters

Curated weekly parameter guidance for major futures contracts — with the ability to expand to additional symbols as the user base requests them.

Purchased separately, the included bar types alone represent $791 in value (LogikDeltaRenko + LogikUltimateRenko + LogikAverageExtreme), before factoring in strategy access and ongoing weekly updates.

What It Does Behind the Scenes

LogikStrategyCore is the shared engine behind every LogikAi strategy. It standardizes detection, AI gating, execution and daily risk governance so each strategy feels different on the chart — but behaves consistently under the hood.

Framework Capabilities

- One Engine, Many Strategies: every LogikAi strategy plugs into a single pattern, filter and AI pipeline, so improvements to the core instantly benefit your whole suite.

- Consistent Signal Logic: unified pattern engine interprets multi-bar structure, displacement and imbalance the same way across symbols, sessions and bar types.

- AI Gating Built-In: LogikAi probability scores are handled centrally — from enforcing minimum P(win) thresholds to passing through confidence bands for position-size boosting.

- Shared Risk Governance: daily goal/loss limits, high-water mark trailing lockouts and soft shutdown logic are applied the same way, no matter which strategy you’re running.

- Broker-Safe Execution Kernel: consolidated OnOrder/OnExecution handling for entries, partial fills, exits and time-outs — designed to be resilient across brokers and data feeds.

- Session & Kill-Zone Awareness: understands RTH/ETH, news windows and quiet hours, so the same strategy can tighten up during high-energy sessions and stand down when markets are dead.

- Live Telemetry & Feedback: tracks P(win), MFE/MAE, trade duration and expectancy so you can validate edges, compare strategy variants and feed clean data back into the LogikAi optimization loop.

Framework Specs

Architecture

Modular C# framework with shared services for pattern, filters, risk and AI inputs.

AI Integration

Pluggable LogikAi models with probability thresholds and confidence bands for size boosting.

Risk Governance

Per-day goal/loss limits, trailing high-water marks, soft lockout and recovery controls.

Execution Logic

Atomic order control, partial-fill aware targets/stops, and broker-agnostic routing.

Filter Intelligence

Regime, volatility and time-of-day filters shared across all strategies.

Telemetry

Export-ready trade logs, equity curves and model-feedback metrics for deeper analysis.

Performance & Risk Use Cases

LogikAi gives you a live probability of win and a consistent risk framework. This section shows how to turn those numbers into practical decisions — when to filter, when to size up, and when to stand down.

Using P(win) in Day-to-Day Trading

The LogikAi probability output is designed to be usable, not just interesting. Here are a few patterns for applying it without overcomplicating your workflow.

- Filter-Only Mode: pick a single cutoff (for example P(win) ≥ 0.60) and treat anything below as “do not trade”. Position size stays fixed — probability simply controls which setups make it to the chart.

- Two-Tier Sizing: use one band for normal risk and one for boosted risk. For example: 0.60–0.69 = base size, ≥0.70 = +1 unit within your max risk. Below 0.60, skip.

- Chop Protection: when you notice a string of low P(win) readings and choppy price, use the probability as a “market is not ideal” signal and stand aside, even if the rules technically fire.

- Session-Aware Thresholds: use a slightly higher cutoff in slower sessions (for example lunchtime) and a slightly lower cutoff in your primary “kill zones” where follow-through is usually better.

These examples are illustrations, not recommendations. Actual cutoffs and sizing rules should be calibrated to your own account size, risk tolerance, and test results.

Daily Risk & Behavior Guardrails

LogikStrategyCore’s risk governance can pair with LogikAi’s probabilities to keep behavior consistent — especially on hot and cold days.

- Daily Goal / Loss Limits: combine traditional PnL limits with probability awareness. For example, after a daily goal is hit, only allow trades with P(win) in the highest band — or stop completely.

- Cold-Streak Protection: if a run of losing trades occurs while P(win) has been low or drifting down, let the framework auto-disable the strategy for the rest of the session or switch to “filter-only” mode.

- High-Energy Windows: during your preferred “kill zones”, allow a slightly more aggressive size band when P(win) confirms the edge. Outside those windows, require both higher P(win) and tighter risk.

- Review Loop: use the logged P(win), MFE/MAE and duration metrics to review which bands and times of day are actually pulling their weight, then tighten your rules around what’s working.

LogikAi supplies the probabilities and the framework supplies the guardrails — you choose how aggressively to translate those into live size and participation rules.

Who LogikAi Is For

LogikAi is built for traders who like clear rules, but want help deciding when those rules are worth taking risk on. Different strategies speak to different trading styles — all powered by the same AI engine.

You want clean entries and fewer “why did I take that?” trades.

Ideal for traders focused on short, high-energy moves in instruments like NQ, ES, CL, GC, and major FX pairs.

- Prefer defined setups on structured bar types (DeltaRenko, UltimateRenko, etc.).

- Want a way to skip low-quality chop without rewriting your entire playbook.

- Like the idea of boosting size only when win-probability earns it.

You care about frameworks, not one-off black boxes.

Built for traders who maintain multiple strategies and want them governed by the same risk and execution core.

- Run more than one strategy and want consistent behavior across all of them.

- Care about expectancy, P(win), MFE/MAE, and how they evolve over time.

- Want an AI layer that can be tuned and reviewed, not a sealed “black box”.

You still drive — LogikAi helps with the throttle.

For traders who like to see the chart, make the final call, but want objective help gauging trade quality.

- Use indicators and levels already, but want a probability read on each setup.

- Happy to trade smaller or skip entirely when the odds aren’t in your favor.

- Prefer to keep control of on/off switches and risk limits, with AI as a decision aid.

If you recognize your own style in any of these groups, LogikAi is designed to plug into what you already do — not force you into someone else’s template.

Frequently Asked Questions

A few of the most common questions about how LogikAi works, how it fits into your trading, and what you actually get when you license the suite.

Do I need to understand AI or machine learning to use LogikAi?

No. The AI work is done upfront. You work with probabilities, thresholds and size options, not algorithms. The interface is exposed as: win-probability on the chart, filters, and inputs for things like minimum P(win) and optional size boosting rules.

Is LogikAi fully automated, or can I still trade manually?

You can use it either way. LogikAi strategies are built to run as automated NinjaTrader 8 strategies, but you can also use the signals and probabilities in a discretionary workflow — for example, only taking trades that clear your probability threshold while you retain the final say on entries.

Does LogikAi replace my trading plan?

No. LogikAi is a decision and risk engine. It can help standardize entries, exits and daily risk behavior, but you still define your account-level risk, which markets you trade, trading hours, and how you want to use probability (filter-only vs. size boosting).

Which markets is this designed for?

The current focus is on liquid futures such as ES, NQ and YM, with weekly parameter guidance provided for those markets. Other futures, FX or crypto instruments can be explored, and additional symbols can be added to the parameter coverage list based on user demand.

Is this just curve-fitted to one market or period?

No. The models are trained on outcome distributions across many trades, not on forcing a particular backtest curve. Probability thresholds and feature weights can be updated as regimes change, and live trades are logged (P(win), PnL, MFE/MAE, duration) to monitor whether edges are holding up.

How often are models or parameters updated?

Weekly guidance is provided for trade parameters in key futures markets (ES, YM, NQ) so your targets, stops and filters stay aligned with current volatility. Strategy and framework updates are released as needed; new LogikAi strategies are included under the same suite license when they go live.

Is this a black box?

The underlying AI method is proprietary, but what goes in and what comes out is fully visible. You see the inputs the model uses, the probability it outputs, the thresholds being applied, and the orders the strategy sends. The goal is to add intelligence to a transparent framework, not hide behavior.

What platform do I need to run LogikAi?

LogikAi is currently offered for NinjaTrader 8 on Windows. The suite includes the necessary custom bar types (LogikDeltaRenko, LogikUltimateRenko and LogikAverageExtreme) so you don’t have to purchase them separately.

Still have questions? Reach out before you purchase and we can clarify whether LogikAi is a good fit for your style, markets and risk preferences.