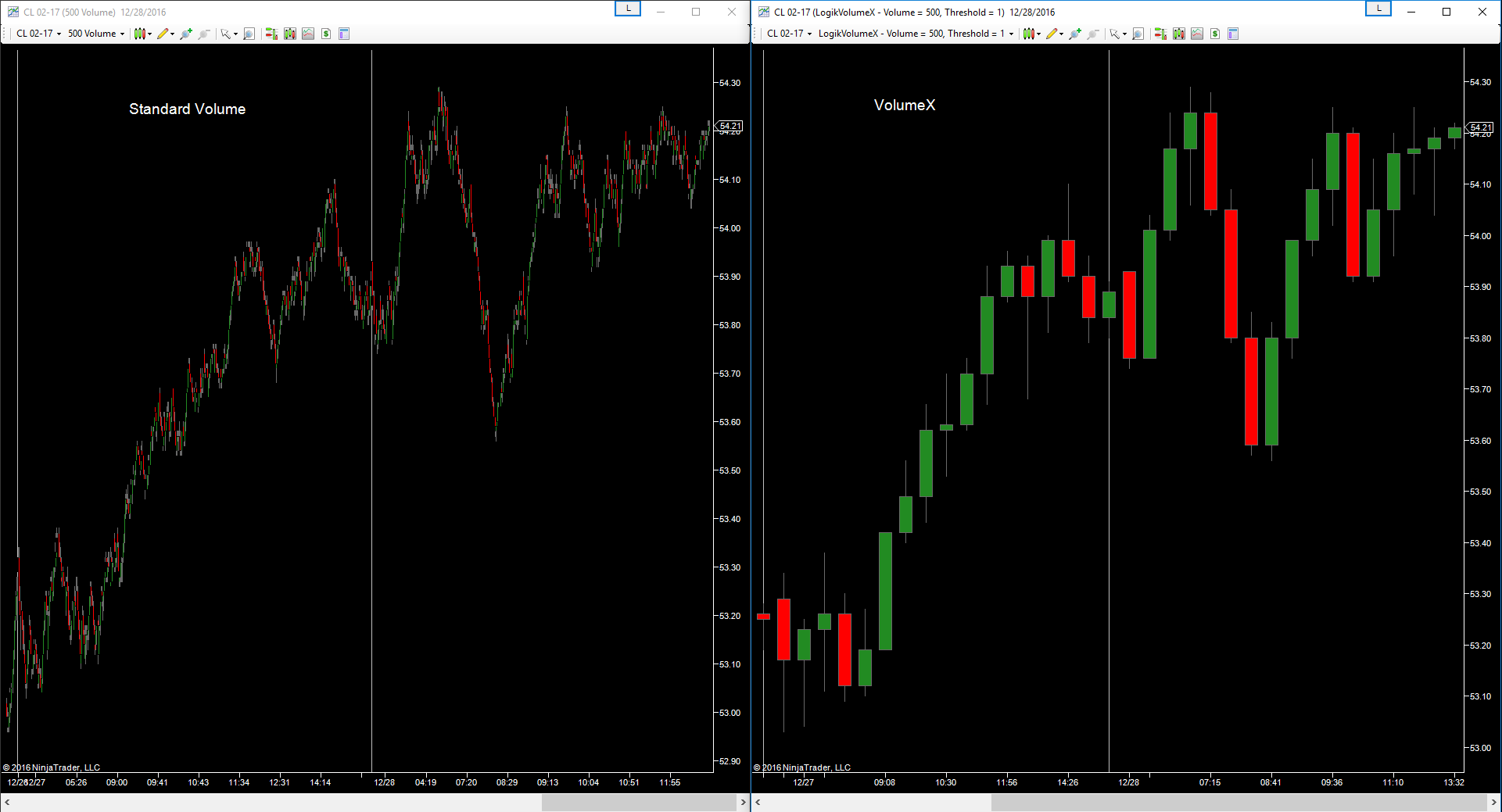

Are all ticks created equal? A tick is a tick, right? Here at PureLogikTrading, we believe the answer to these questions is “No.” If we’re correct, a tick chart does not correctly represent the market, and therefore, the evolution of the tick chart must occur. This evolution is the LogikTickX improved Tick bar, and LogikVolumeX improved Volume bar.

A traditional tick chart is based on a specific number of ticks (trades). A bar will build until the specified number of ticks is reached, with the next tick resulting in a new bar starting.

Since many large quantity traders mask the size of their orders by breaking them up into smaller orders, this method does not represent the “true” tick; their transaction is hidden. It is now many ticks which reach the market that form the true transaction. It is for this reason we believe all ticks are not created equal and that only one tick should represent the one true transaction.

The LogikTickX and LogikVolumeX utilize signal processing and price reconstruction techniques to cut through the noise, reconstructing the true transaction, and thereby minimizing the ability of traders to hide large orders. This allows you to identify and react better to the true market sentiment, giving clearer analysis, signals, and correlation between price and volume development.

$147.00

Single Transaction Reconstruction

Utilizing transaction reconstruction techniques, a trader’s method of hiding a large transaction by breaking up the transaction to many smaller transactions diminishes. The result is a tick bar that is based on the “true” ticks, which provides a better representation of the market.

Tick Volume Threshold

Only want the larger transaction ticks to be represented by the formation of the tick bar? By granting the user the option to set the transaction volume threshold, he can set which ticks count, and which don’t. If a large order is submitted and destructed by the broker or fill algorithm, the reconstruction algorithm will reconstruct the transaction and determine if it passes the volume threshold. There is no limitation that a single tick volume must surpass the volume threshold. This powerful feature allows you to see the representation of the bigger traders; those who typically move the market.

The image to the right shows the effects of a 5 volume threshold requirement.