Three Line Break charts display a series of vertical boxes that are based on changes in prices. This chart type ignores the passage of time.

The following are three basic trading rules for a three line break chart:

- Buy when a green bar emerges after three adjacent red bars.

- Sell when a red bar emerges after three adjacent green bars.

- Avoid the market when the bars are alternating between red and green

What makes the LogikLineBreak different from the traditional LineBreak chart type? Perhaps the most noteworthy is the ability to backtest accurately.

$147.00

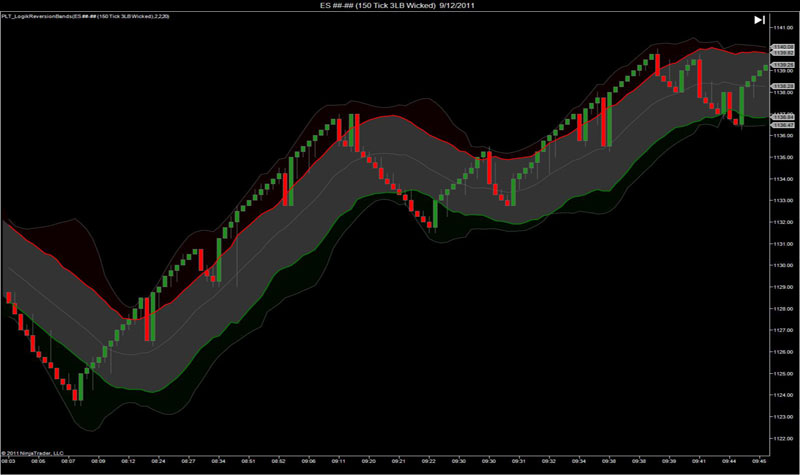

True Wick Display

The LogikLineBreak can depict the true High / Low with a candle chart like wick to reintroduce this important price information lost with the traditional LineBreak bar, while maintaining the benefit of isolating the underlying price trend. The LogikLineBreak is configurable to display either the traditional brick without the wick, or display the brick with the wick.

Wick display benefits:

- Large wick-to-brick ratio illustrates strong indecision / possible reversal

- Small wick-to-brick ratio illustrates little to no indecision / less likelihood of reversal

- Congestion areas can be analyzed more efficiently with the true price

- A wick endpoint can be utilized to determine an adaptive / dynamic trail more easily

- A wick endpoint can be utilized to determine Support / Resistance areas more easily

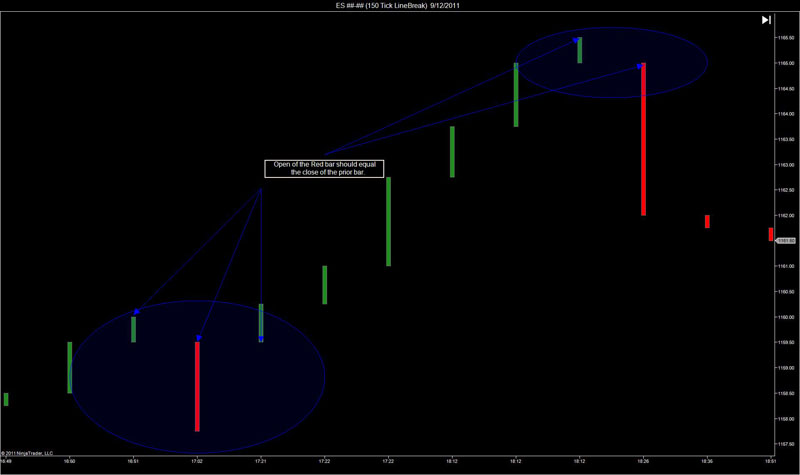

CloseToOpen Reversal Display

The Open price of the reversal brick is traditionally the same as the Open of the previous brick. This is not the TrueOpen price of a reversal brick, and is NOT backtestable in NinjaTrader with any degree of accuracy.

When a reversal brick is created, the Open of the reversal bar should paint at the previous brick Close. To properly depict this, the CloseToOpen implementation sets the Open of the reversal brick to the Close of the previous brick. Although this may not be as visually appealing to some, it represents the TrueOpen of the reversal, as well as properly performs a buy / sell at next bar open strategy order during a strategy back-test execution.