See Your Trading Logic in Action — and Let AI Refine It

LogikLab turns your chart signals into full trade simulations with instant performance analytics.

LogikLabAi takes it further, adding AI intelligence that learns from your results and filters trades by probability.

No subscriptions • Runs entirely inside NinjaTrader • Lifetime license

You Can’t Improve What You Can’t Measure

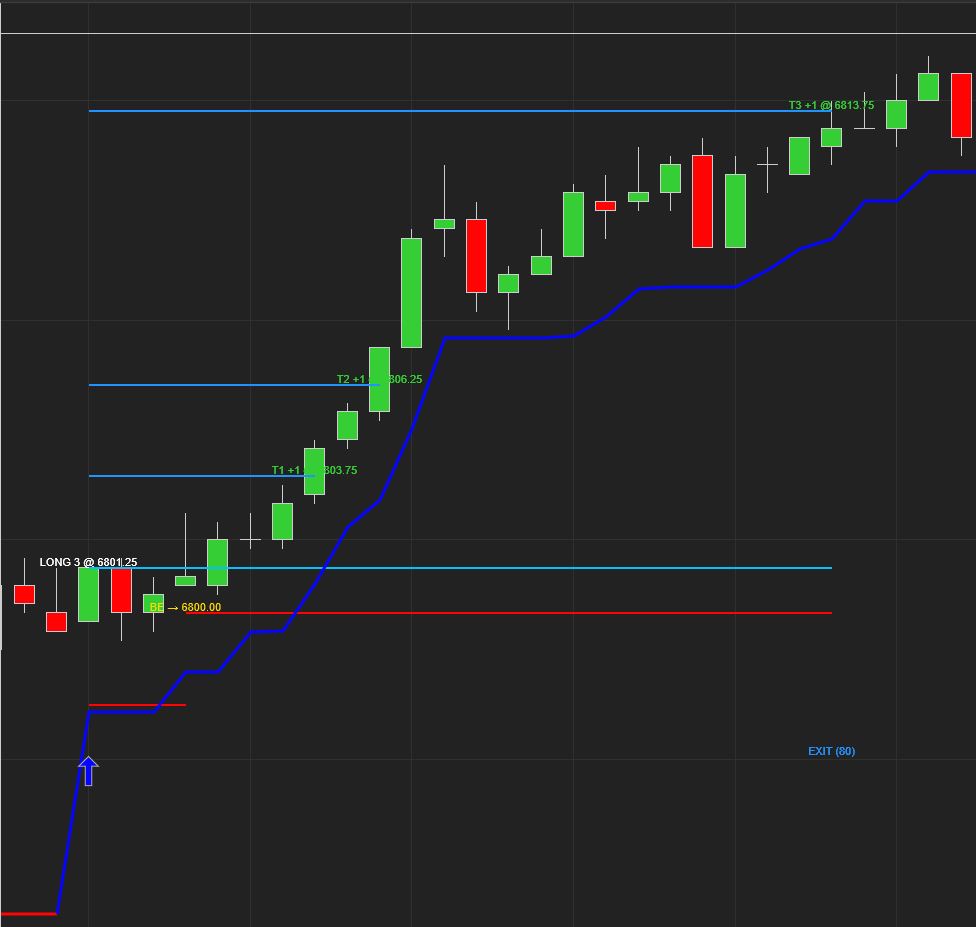

LogikLab reads the chart signals you already see and turns them into realistic trade simulations — applying your stops, targets, break-even, and trailing logic automatically so you can see true performance on your chart.

No exports. No coding. Just load your chart, and let LogikLab show you exactly how your signal behavior performs under realistic trade management conditions.

- ✓Reads chart arrows (Up/Down) as entries

- ✓Simulates full trade flow: entries, exits, T1–T3, stop, BE, trail

- ✓Equity curve, KPIs, PnL & duration histograms

- ✓Time-of-day & session filters (RTH/ETH)

- ✓Baseline vs variant comparison reports

Take It Further with AI-Powered Intelligence

Once you understand how your signals behave, the next step is to make them smarter. LogikLabAi builds on LogikLab and adds machine-learning precision that studies every simulated trade — identifying probabilities, patterns, and trade confidence in real time.

Move beyond static rules. Filter trades dynamically by probability and keep your strategy aligned with changing market behavior — without constant manual tuning.

- ✓Probability scoring on every trade

- ✓Confidence-based filtering with adjustable thresholds

- ✓Adaptive model that evolves with new data

- ✓Optional confidence-weighted position sizing

Choose Your Version

Both editions include the full LogikLab simulation engine. LogikLabAi adds adaptive intelligence and probability-based filtering for maximum precision.

LogikLab

On-chart trade simulation and performance analytics.

- ✓Reads chart arrows (Up/Down) as entries

- ✓Full trade management: targets, stops, break-even, trailing

- ✓Equity curve, KPIs, PnL & duration histograms

- ✓Time-of-day & session filters (RTH/ETH)

- ✓Baseline vs variant comparison reports

LogikLabAi

All of LogikLab, plus adaptive AI intelligence.

- ✓Everything in LogikLab

- ✓Probability scoring on every trade

- ✓Confidence-based filtering with adjustable thresholds

- ✓Adaptive model that evolves with market behavior

- ✓Optional confidence-weighted position sizing

No subscriptions. Free lifetime updates. Start with LogikLab and upgrade anytime.

Built for Real Traders

Accurate Analytics

Understand your strategy’s true edge with clear, on-chart results and performance metrics.

Instant Simulation

No data exports or complex setup — LogikLab works directly on your existing chart signals.

AI That Learns

LogikLabAi evolves automatically, refining your edge with each new trade.

“I thought my setup was consistent until LogikLab showed me the truth.

Within a day I improved my win rate just by filtering bad signals.”

— E.M., Futures Trader