Range bars take only price into consideration, therefore, each bar represents a specified movement of price and time is eliminated from the equation.

When creating traditional range bar charts, there are three rules.

- Each range bar must have a high / low range that equals the specified range.

- Each range bar must open outside the high / low range of the prior bar.

- Each range bar must close at either its high or its low.

There are two fundamental flaws with this design, as described below

$247.00

Enhancement 1 – Static Range vs Dynamic Range Calculation

First, the range utilized by the bar is static. Specifying the degree of price movement for creating a range bar is not a one-size-fits-all process. Different trading instruments move in a variety of ways. A typical solution to this issue would be to determine the Average True Range for an instrument, and specify the range bar input to that value or some close variant thereof. While this method is descent, an ATR lags based on the period specified, and it fails to dynamically adjust the range as the volatility of the day changes. Specifically, an instrument is more volatile during a session start time.

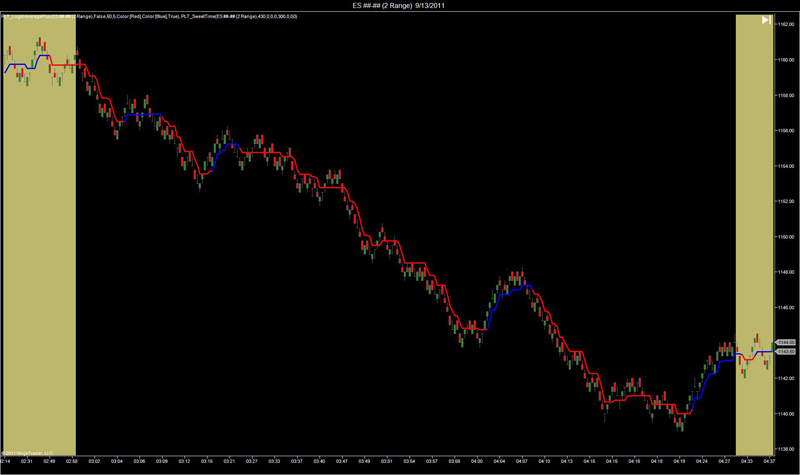

The LogikDynamicRange solves this issue by employing a non-lag range determination technique. Rather than using a lagging ATR, the LogikDynamicRange algorithm adapts itself bar by bar, detecting and resolving any computed error from the prior bars range. The algorithm then utilizes this error to compute the next range bar size. This continuously adaptive technique sizes the bar throughout the day, capturing trends while displaying consolidation areas very easily.

The LogikDynamicRange features two controls for the algorithm. A minimum range, and a maximum range. These inputs define how small / large the bar can get, allowing the trader to fit his / her trading style.

Using a simple indicator, the LogikRange (which is free with this bar type) depicts the areas where the range is adapting to a larger size, and therefore a trend is developing. The red vertical lines depict potential entry points short, during the European Market Open.

Enhancement 2 – Open outside of High / Low vs Open @ Prior Bar Close

A second flaw with the traditional Range bar is that the open price of a new range is drawn outside of the high / low range of the previous bar. This introduces 1 tick of noise on each new bar, which leaks into any indicator that is applied. While the LogikDynamicRange follows this rule when forming a new brick, the actual opening price of the bar is displayed at the prior bar close. Utilizing this technique, any indicator applied to the LogikDynamicRange has 1 tick per bar of noise removed from its computation, and therefore it’s smoother and more responsive.

Adaptive Brick Size (Daily Basis)

The LogikDynamicRange has the ability to dynamically determine the appropriate min and max brick size to best adapt to market conditions. The unique algorithm constantly monitors market data on a tick by tick basis to self tune the brick size throughout the day. An indicator (below) is include for this computation.